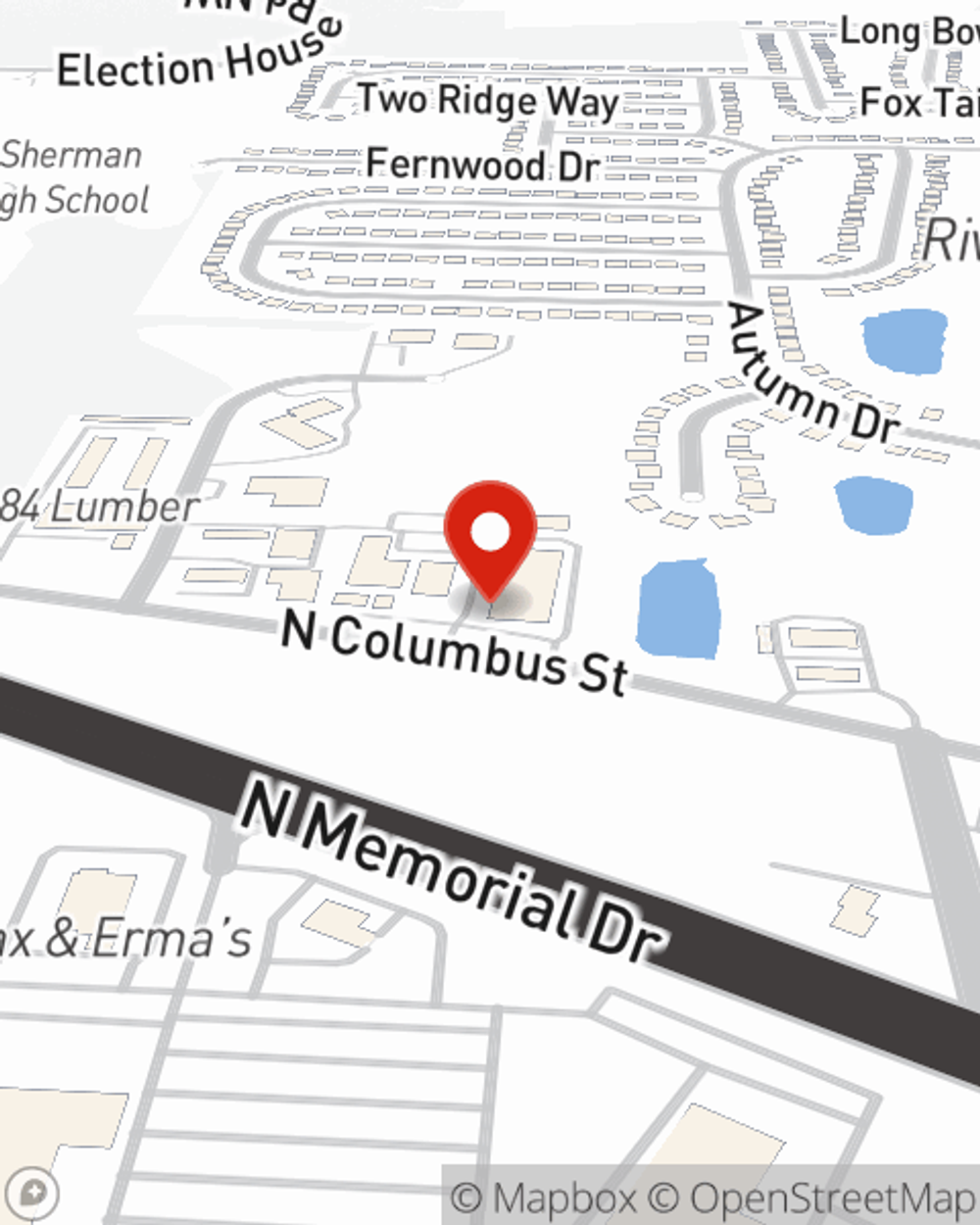

Business Insurance in and around Lancaster

One of Lancaster’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

- 43130

- 43147

- 43110

- Fairfield County

- Hocking County

- Licking County

- Franklin County

- Perry County

This Coverage Is Worth It.

Running a small business comes with a unique set of wins and losses. You shouldn't have to work through those alone. Aside from just your loved ones, let State Farm be part of your line of support through insurance options including business continuity plans, errors and omissions liability and a surety or fidelity bond, among others.

One of Lancaster’s top choices for small business insurance.

Helping insure businesses can be the neighborly thing to do

Insurance Designed For Small Business

At State Farm, apply for the great coverage you may need for your business, whether it's a drug store, a donut shop or a florist. Agent Jesse Jones is also a business owner and understands your needs. Not only that, but customizable insurance options is another asset that sets State Farm apart. From one small business owner to another, see if this coverage can't be beat.

Get right down to business by calling or emailing agent Jesse Jones's team to talk through your options.

Simple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?

Jesse Jones

State Farm® Insurance AgentSimple Insights®

Fire safety for businesses

Fire safety for businesses

Learn workplace fire safety and prevention tips to help protect your employees and business.

Small business types

Small business types

What is a sole proprietorship, an LLC and other small business types — and which one is best for you?