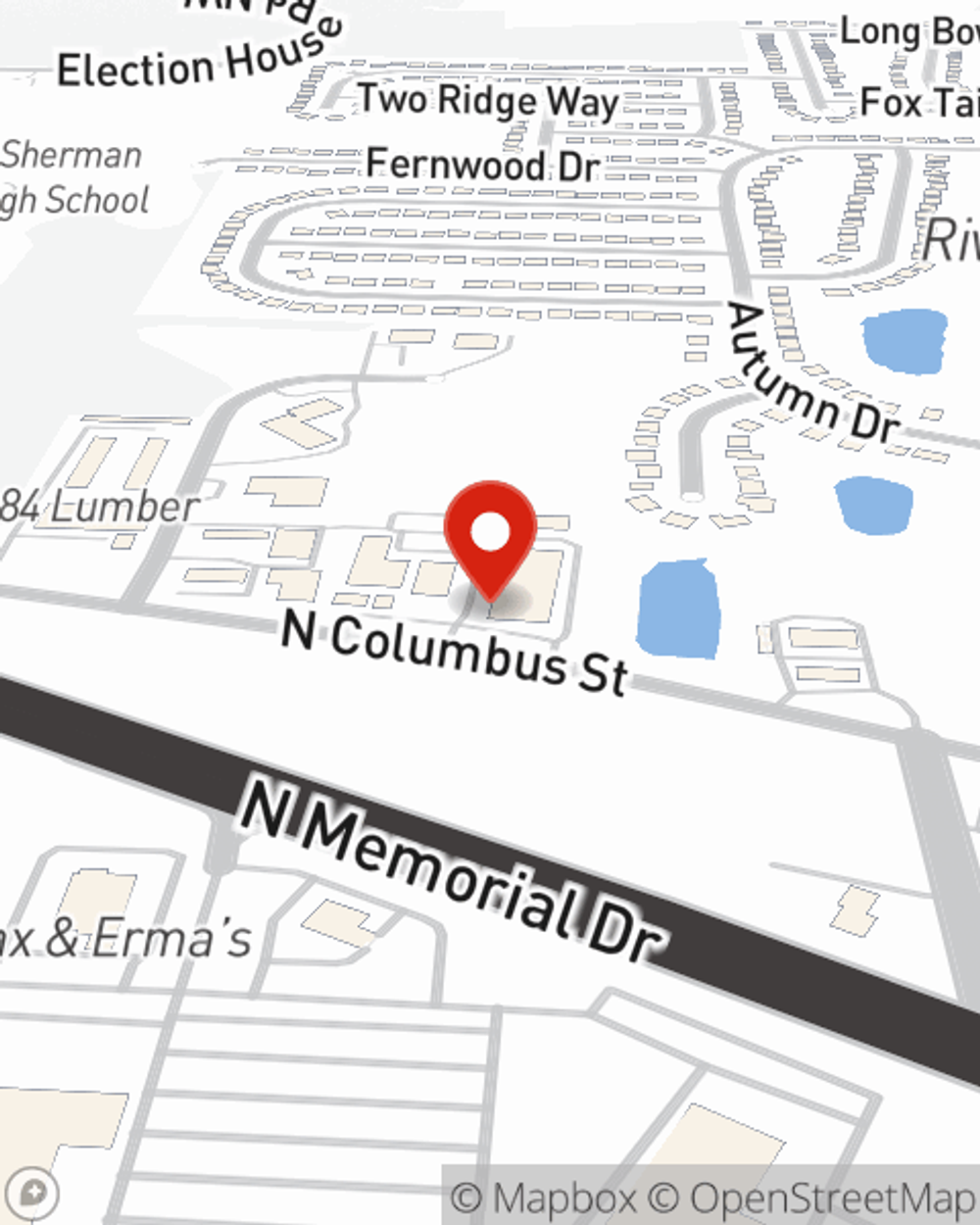

Homeowners Insurance in and around Lancaster

Looking for homeowners insurance in Lancaster?

Give your home an extra layer of protection with State Farm home insurance.

Would you like to create a personalized homeowners quote?

- 43130

- 43147

- 43110

- Fairfield County

- Hocking County

- Licking County

- Franklin County

- Perry County

Insure Your Home With State Farm's Homeowners Insurance

Being at home is great, but being at home with coverage from State Farm is the cherry on top. This fantastic coverage is more than just precautionary in case of damage from tornado or windstorm. It also can cover you in certain legal cases, such as someone having an accident in your home and holding you responsible. If you have the right coverage, these costs may be covered.

Looking for homeowners insurance in Lancaster?

Give your home an extra layer of protection with State Farm home insurance.

Why Homeowners In Lancaster Choose State Farm

With this terrific coverage, no wonder more homeowners pick State Farm as their home insurance company over any other insurer. Agent Jesse Jones would love to help you choose the right level of coverage, just visit them to get started.

Let us help with the details of keeping your valuables protected with State Farm's outstanding homeowners insurance. All you need to do to get the ball rolling is contact Jesse Jones today!

Have More Questions About Homeowners Insurance?

Call Jesse at (740) 785-4511 or visit our FAQ page.

Protect your place from electrical fires

State Farm and Ting* can help you prevent electrical fires before they happen - for free.

Ting program only available to eligible State Farm Non-Tenant Homeowner policyholders

Explore Ting*The State Farm Ting program is currently unavailable in AK, DE, NC, SD and WY

Simple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Fire safety equipment to have at home

Fire safety equipment to have at home

Every residence should be prepared with home fire safety equipment to help in case of an emergency.

Jesse Jones

State Farm® Insurance AgentSimple Insights®

Tips to help prevent water leakage at your business or home

Tips to help prevent water leakage at your business or home

Help prevent water damage in the workplace and at home by checking on appliances and installing leak detection systems.

Fire safety equipment to have at home

Fire safety equipment to have at home

Every residence should be prepared with home fire safety equipment to help in case of an emergency.